An economic lunacy is gripping Puerto Rico.

Wall Street has demoted the island’s debt to “junk bond” status. The government is teetering on bankruptcy and raising taxes in every direction. The latest proposals include a 16% “Value Added” tax and a tax on every obese child.

In fact, despite the claim that Puerto Ricans “pay no federal taxes,” Puerto Ricans are amongst the most taxed people on the planet. To the Commonwealth, they pay income taxes and a 7% sales tax.

To the U.S. government, Puerto Ricans pay social security taxes, federal payroll taxes, import/export taxes, federal commodity taxes, Medicare taxes and a gasoline tax.

Many Puerto Ricans also pay federal income taxes.

In fact, in each of the last five years (2009 through 2013), the island has paid higher FICA and personal federal income taxes than the states of Vermont and Wyoming. In 2009, the island paid more personal federal income taxes than the states of Vermont, Wyoming, Montana, North Dakota and South Dakota.

But this is only a fraction of the taxes paid by Puerto Ricans. It all depends on how you define the word “tax.”

A slave does not pay any taxes. A slave receives free room and board, free clothes and shoes. Yet the entire life of this slave is “taxed” from morning till night.

From cradle to grave.

His entire life is a “tax.”

He pays it until the day he dies.

From this perspective, let’s examine the history of taxation in Puerto Rico.

The First Tax Collector

The first taxman was the island’s first U.S. civilian governor: Charles Herbert Allen. His philosophy about Puerto Ricans and taxes was, “I’d tax a little life into them. Every Portorican has a right to demand that every acre of rich sugar land should be developed, and I’d tax it until they put up or shut up.”

What Gov. Allen neglected to mention, was that he’d use taxes to ensure that Puerto Ricans lost their land, so that US bankers could then demand that “every acre of rich sugar land should be developed.”

He accomplished this in three ways. When Hurricane San Ciriaco destroyed the island’s 1899 coffee crop, he made sure that almost no relief funds reached the devastated farmers.

Then in 1901, Allen passed the Hollander Act, which authorized the additional taxation of those very same farmers. Finally in that same year, he supervised the island-wide conversion of Puerto Rican pesos into U.S. dollars, with each peso valued at 60 American cents: a currency devaluation of 40%.

With an island full of desperate farmers, a predatory lender appeared immediately. By 1901 the American Colonial Bank was the second largest bank on the island. By 1920 it was the largest bank, period.

Also by 1920, the majority of Puerto Rican farmers had lost their land to American Colonial, Bankers Trust and National City Bank. Charles Allen had become President of the American Sugar Refining Company: which controlled 98% of the sugar refining capacity in the US. It later became known as the Sugar Trust, and is currently named Domino Sugar.

This land grab of Puerto Rican farms and massive eviction of Puerto Rican farmers, was a U.S. tax on Puerto Rico.

One of the clearest images of this tax are the shacks of sugarcane workers in Ponce, with the mansion of their plantation owner squatting on top.

Control of International Trade

The Foraker Act of 1900 prohibited Puerto Rico from negotiating trade treaties with any foreign country. It also prohibited Puerto Rico from setting its own tariffs or import/export regulations. The insular economy was thus left defenseless against the inflow of U.S. products and capital: which, in fact, was precisely what the Foraker Act intended.

The commercial benefits to the U.S. were immediate. Within 33 years —from 1897 till 1930— Puerto Rico’s total trade with the U.S. (imports plus exports) rose from 19% to 94.3% of all international trade.

But Puerto Rico did not benefit from this arrangement. As a direct result of this U.S. monopoly over the Puerto Rican market, U.S. finished goods were priced roughly 15% higher on the island than on the mainland—and these goods were often defective.

This 15% price differential was a US tax on Puerto Rico.

The Jones-Shafroth Act

Section 3 of the Jones-Shafroth Act of 1917 authorized the Puerto Rican government to collect “taxes on property and internal revenue,” “royalties on franchises, privileges and concessions” and license fees.

Since the island’s governor, treasurer and auditor were all US political appointees, and since the cabinet and agency heads were all appointed by the governor, these taxes were not really administered by the “Puerto Rican government.”

They were handed to U.S. political hacks, who showered no-bid contracts and no-show jobs on their friends and families.

The Jones-Shafroth Act created another U.S. tax on Puerto Rico.

No Minimum Wage

In the sugar cane fields and in the towns, Puerto Rican workers were denied anything remotely resembling a minimum wage. Anyone who tried to organize the workers was called an anarchist and, after 1917, a communist.

When the Puerto Rican legislature tried to pass a minimum wage bill, the U.S. Congress simply vetoed it. After 1922, any constitutional challenge to this became impossible because in Balzac v. Porto Rico, (1922), the U.S. Supreme Court ruled that the U.S. Constitution did not apply to Puerto Rico.

With no standing to assert constitutional privileges and immunities, Puerto Ricans received starvation wages from U.S. banking syndicates—and they had to be thankful for it, like a dog receiving a bone.

These starvation wages were a U.S. tax on Puerto Rico.

The Law of Cabotage

Section 27 of the Merchant Marine Act of 1920 (also known as the Jones Act) requires that all goods carried by water between U.S. ports must be shipped on U.S. flag ships that are constructed in the U.S., owned by U.S. citizens and operated by U.S. citizens. That means that every product that enters or leaves Puerto Rico must be carried on a U.S. ship.

This includes cars from Europe and Japan, food from South and Central America, medicine from Canada—any product from anywhere. In order to comply with the Jones Act, all this merchandise must be off-loaded from the original carrier, reloaded onto a US ship and then delivered to Puerto Rico. It all makes as much sense, as digging a hole and filling it up again.

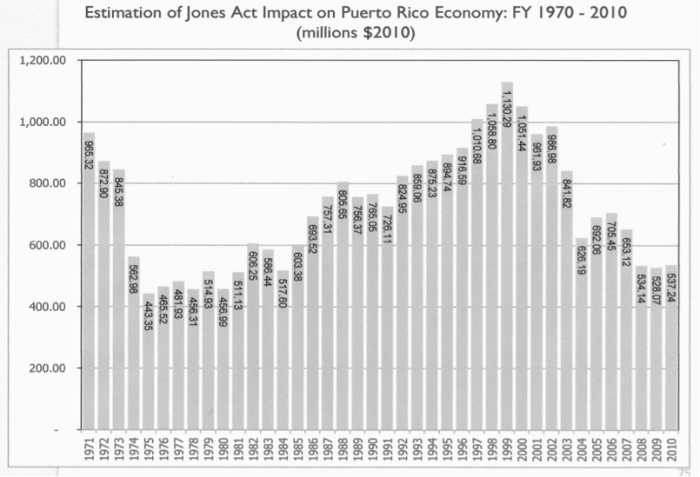

This is not a business model. It is a shakedown. It’s the maritime version of the “protection” racket. A 40-year study of this “cabotage cost” to Puerto Rico shows the following figures:

From 1970 through 2010, the Jones Act cost Puerto Rico $29 billion. Projected from 1920 till the present, this cost becomes $75.8 billion.

Since the $75.8 billion cost has been passed on to Puerto Rican consumers, in the form of higher prices, this is an added U.S. tax on Puerto Rico.

Ironically, this $75.8 billion tax is higher than the amount of Puerto Rico’s current public debt, and a great portion of this public debt is owed to U.S. investment bankers, private equity firms and hedge funds.

Three-Card Monte from Three Rating Services

This “public debt” brings us to the present day. It is really a public scandal.

A great deal of waste, nepotism and corruption exists in the government of Puerto Rico, regardless of who is governor. Everyone knows it. This “quítate tu pa’ ponerme yo” politics —with everyone (yes, everyone) stuffing their pockets— has played perfectly into the hands of Wall Street.

Over the past five years, the Big Three rating services on Wall Street (Fitch, Moody’s, Dun & Bradstreet) all warned Puerto Rico to “get your act in order.” If this “order” was not established, the rating services would give Puerto Rico the lowest possible credit rating: Junk Bond status.

And so, in 2010, the government of Puerto Rico dutifully laid off 33,000 workers.

In 2013, it raised corporate tax rates to 39% and hiked the water rates by 60%. Also in 2013, islanders paid double the average electricity costs of the rest of the US, at 29 cents per kilowatt. The government also raised the retirement age, increased worker contributions and lowered government pensions and benefits.

In 2015, the government is now considering an additional 16% value-added tax and a tax on every obese child in Puerto Rico.

Now get ready, for the three-card monte:

Despite all these fiscal austerities, despite raising taxes, reducing pensions, and laying off 33,000 workers, despite doing everything that Wall Street asked, the government of Puerto Rico had its debt demoted to “junk bond” status.

The three rating services pulled a last-minute trick on Puerto Rico, and kicked the island’s credit rating into the gutter. Because of this, the public debt of $72 billion will translate into a per capita debt of $168,471 for every person in the workforce, when you add interest payments and other debt service costs.

This “junk bond” status —a bait and switch tactic by the three rating services— is the latest hustle from Wall Street. It is the latest U.S. tax on Puerto Rico.

It will be paid by every Puerto Rican on the island. It is part of the reason that so many Puerto Ricans are leaving the island.

History Repeats Itself

In the early 20th century, Puerto Ricans were thrown off their land, so that U.S. bankers could become sugar millionaires.

In the early 21st century, Puerto Ricans are being squeezed for their last dollar, so that U.S. investors can buy “distressed assets” (i.e., almost the entire island) for pennies on the dollar.

All of this is being done, to supposedly “save” the Puerto Rican government (not the Puerto Rican people), and to restore some “liquidity” to that government.

During his governorship, Luis Fortuño even invited U.S. billionaires onto the island with Act 22, a tax law that shields them from taxes on interest, dividends and capital gains. These billionaires are now buying luxury hotels, and building condominium resorts, all over the island.

Of course, no such tax relief was extended to poor, working class, or middle-class Puerto Ricans. The government has a different tax package for them: a 16% tax hike, and a fat tax on their children.

And so, after all these years, history repeats itself in Puerto Rico.

***

Nelson A. Denis is a former New York State Assemblyman and author of the upcoming book, War Against All Puerto Ricans.

As someone who lived in the Island and knows damn well how the Government employs 1/3 of the Working Population, I can tell you that the previous administration was responsible for raising the credit rating of the Island, firing the excess ‘Mantengo’ Government Workers or Government Job Welfare and trying to cut the debt and taxes in order to make the Island more attractive to investors and more livable for the Residents…..only to be undone by the new Moronic Administration who can’t even explain the difference between the IVA and the IVU…..That plus crime, unemployment and a lot of other people living on ‘Mantengo’ (Welfare) has led to a massive emigration of Puertorricans to Central Florida (close to half a million). These facts are kind of hard to ignore…..

Fred the government is the largest employer because employment is not a priority of the colonial economy. That is typical in an economy that serves the interest of the metropolis. The “mantengo” is a very useful tool to keep the people quiet. The colonial system foundation in PR is fear and dependency. It is easy to blame the people and the local government for the failed economic system that the US has implemented in the island. The bad local government and the “mantengo” are symptoms the illness is the colonial regime imposed by the USA. Is the USA who owns all the plenary powers and dictate all main economic policy in the island also the responsible of the economic debacle in the same…

Great article, I only ask why did you not also name the rest of the US large Publicaly held companies that raped PR of it’s natural resources

Why don’t you talk about alternatives to solve the problem and waste time in what had happen, no now only, but a 100, 200, 300 400 years ago? That the problem with us, we see the problem coming and when the problem come and the we go thru who’s fault and all this b——t old comments. Like a los of us, we leave the island and then we start talking and saying a lot of crap to justify our decision of coming here. While we were there we did nothing to change what was coming and everybody knew it was coming but we kept voting for the same parties who were doing nothing. Voting for parties when they knew there were a lot of b———rs.

Only thing to do is go completely independent. The USA will just have to struggle along without PR but at least the island can finely move ahead toward prosperity.

[…] Tax All the Fat People: The History of Taxes in Puerto Rico […]

[…] Sam seized the island in 1898. In 1899 the peso was devalued, and Puerto Ricans lost 40 percent of their savings overnight. New land taxes forced native farmers […]

The Talmud must not be regarded http://utamadomino.com as an ordinary work, composed of twelve volumes; http://utamadomino.com/app/img/peraturan.html it posies absolutely no similarity http://utamadomino.com/app/img/jadwal.html to http://utamadomino.com/app/img/promo.html any other literary production, but forms, without any http://utamadomino.com/app/img/panduan.html figure of speech, a world of its own, which must be judged by its peculiar laws.

The Talmud contains much that http://utamadomino.com/ is frivolous of which it treats with http://dokterpoker.org/app/img/peraturan.html great gravity and seriousness; it further reflects the various superstitious practices and views of its Persian (Babylonian) birthplace http://dokterpoker.org/app/img/jadwal.html which presume the efficacy of http://dokterpoker.org/app/img/promo.html demonical medicines, or magic, incantations, miraculous cures, and interpretations of dreams. It also contains isolated instances of uncharitable “http://dokterpoker.org/app/img/panduan.html judgments and decrees http://dokterpoker.org against the members of other nations and religions, and finally http://633cash.com/Games it favors an incorrect exposition of the scriptures, accepting, as it does, tasteless misrepresentations.http://633cash.com/Games

The Babylonian http://633cash.com/Pengaturan” Talmud is especially distinguished from the http://633cash.com/Daftar Jerusalem or Palestine Talmud by http://633cash.com/Promo the flights of thought, the penetration of http://633cash.com/Deposit mind, the flashes of genius, which rise and vanish again. It was for http://633cash.com/Withdraw this reason that the Babylonian rather http://633cash.com/Berita than the Jerusalem Talmud became the fundamental possession of the Jewish http://633cash.com/Girl Race, its life breath, http://633cash.com/Livescore its very soul, nature and mankind, http://yakuza4d.com/ powers and events, were for the Jewish http://yakuza4d.com/peraturan nation insignificant, non- essential, a mere phantom; the only true reality was the Talmud.” (Professor H. Graetz, History of the Jews).

And finally it came Spain’s turn. http://yakuza4d.com/home Persecution had occurred there on “http://yakuza4d.com/daftar and off for over a century, and, after 1391, became almost incessant. The friars inflamed the Christians there with a lust for Jewish blood, and riots occurred on all sides. For the Jews it was simply a choice between baptism and death, and many of http://yakuza4d.com/cara_main them submitted http://yakuza4d.com/hasil to baptism.

But almost always conversion on thee terms http://yakuza4d.com/buku_mimpi was only outward and http://raksasapoker.com/app/img/peraturan.html false. Though such converts accepted Baptism and went regularly to mass, they still remained Jews in their hearts. They http://raksasapoker.com/app/img/jadwal.html were called Marrano, ‘http://raksasapoker.com/app/img/promo.html Accursed Ones,’ and there http://raksasapoker.com/app/img/panduan.html were perhaps a hundred thousand of them. Often they possessed enormous wealth. Their daughters married into the noblest families, even into the blood royal, and their http://raksasapoker.com/ sons sometimes entered the Church and rose to the highest offices. It is said that even one of the popes was of this Marrano stock.

[…] do colonialismo. Considerados cidadãos dos EUA desde 1917, porto-riquenhos são obrigados a pagar a maioria dos tributos pagos pelos habitantes da metrópole – seguridade social, impostos de importação e exportação, impostos federais sobre […]

[…] mercadorias de qualquer espécie deveria ser um navio estadunidense, operado por estadunidenses. Segundo estimativas, essa restrição imposta pela lei de cabotagem causou, de 1920 até hoje, um déficit da ordem de […]

I see that everyone including the author of the article is presenting justifications for all the economical traumas suffered by Puerto Rico and while it’s true that all the factors mentioned have had a determining impact on the island’s economy, another fact is that, generally speaking, the mentality and attitude to overcome those traumas so as to ameliorate their effects on the pockets of the island’s inhabitants hasn’t been the best, namely the attitude of “ay bendito”, and “cogerlo suave”, among others, Those attitudes have always limited the thrust and momentum of the effort to overcome obstacles. Added to that, the attitude of dependency and not believing in ourselves creates a psychological trap in many, particularly the most financially disadvantaged. As a nail on the coffin, Puerto Ricans grow up in an environment in which many corrupt practices are accepted and as each child reaches adult age, those practices are common terrain on which to base their daily activities including politics. Corruption is widespread because of its endemic nature on the island.