On Friday, Latino Rebels received the following account from a Puerto Rican woman who asked us to not use her name. Here is what she wrote. (FYI, we had reached out to Wells Fargo last weekend when we found out about her story.)

I live in Peachtree Corners, Georgia.

I currently own a condo in Puerto Rico, which is managed by my 73-year-old mother, who lives about 2-3 miles from my condo. As you know, in September of 2017, Hurricane María took a devastating stroll throughout our beautiful island, leaving millions of dollars in damages and not to mention the amount of lives it took along the way.

My condo and property management had some damage. Since my damage was not as devastating, compared to others who lost everything, I decided to “take my number” and wait my turn until the HOA management company processed our claim with the insurance company.

I didn’t get my insurance check until last Saturday, February 16, 2019. I was so excited to finally deposit the check and send the money to my mother so she can proceed with the necessary repairs.

As a loyal customer of Wells Fargo (11 years to be exact), I went to the branch close to my residence in Georgia, and used the drive-thru option to deposit the check. The nice clerk sees the check and says: “I need to confirm with my manager, since this is a big check that’s written in Spanish.”

A few minutes she comes back and says: “Everything is great! Thanks and have a wonderful weekend!” So I deposit the check and head back home. Once I get home, I check my account via the Wells Fargo app and see the money in “pending” status with a “+” sign by the amount. Everything looks great!

About an hour later, I get a call from Wells Fargo. “Please call back.” No extension number, no last name. I’ve tried to communicate and was not successful. I got worried so decided to check the app again when I see the amount has been “reversed.”

I think: “This couldn’t BOUNCE!” So I decide to go back to the branch.

As I am on my way thinking that the check bounced, I call my mother in Puerto Rico to have her ready on the phone.

The assistant manager comes to me because the manager “is not available to speak right now.” She proceeds to ask for my ID. She has the check in her hands.

The assistant manager said something about how the bank cannot accept the check “because it is in Spanish.

“You are in an English-speaking country,” she says. “We need the check in English.”

This is what I say: “Well, the check is current, signed from an insurance company. The things you need to pay attention are the date, routing number, and account number attached to the check. Why does it need to be in English? I don’t understand.”

“Our computer doesn’t read Spanish,” the assistant manager says. “If the check bounces, you will be in trouble.”

My mother is hearing this conversation over the phone and asks to speak with the lady. I tell the lady. The lady’s response?

“I can’t speak to her. I don’t speak Spanish. And we don’t have a Spanish speaker on staff,” she says as she waves her hands at me.

My response: “Do you know how insulting this is? First of all we are fully bilingual. She probably speaks better English than you.”

My mom disconnects the call. She is furious.

My frustration continues.

“Let me get this straight, you are saying that Wells Fargo, a nationwide multi-billion company doesn’t have the software to translate any check from any language? If that is the case, why I could see the money deposited in my account in the first place? If it couldn’t read the check, it wouldn’t made it that far, right? Do you see the check says this is from Hurricane María? I’ve been waiting for this since 2017.”

I then ask for the check and my ID back.

“If you can have a check in English we will be happy to deposit it,” she tells me.

When I grab the check, I see it was endorsed in the back then crossed over with blue ink pen.

I leave the Wells Fargo branch.

On Tuesday, February 19, my mother gets on hold with the manager of my HOA in Puerto Rico. She explains the situation (which I emailed them as well that same Saturday, including the picture of the endorsed voided check). The HOA says they need to run this by their lawyers because looks like I’ve deposited the check, and I am asking for another one. Also, we’ve explore the idea of them cutting the check on my mother’s name directly so she can deposit it there instead of waiting for it to come to Georgia.

Finally, we get the answer from the lawyers. First, they cannot cut the check on my mother’s name. Second, they request the voided check back. Third, once they receive the check, and it’s proven was not cleared, then they will send another check back.

Meanwhile, Wells Fargo calls me to apologize for the situation.

“But if you have the check in English…”

I cut him in the middle of the speech (quite annoyed of course). I tell him what I have to do now, just because Wells Fargo simply cannot read Spanish.

His answer is this: “Damn!”

And I disconnect the call. Suddenly, for no reason nor relevance whatsoever Wells Fargo emails me to let me know that “we’ve increased your daily purchase limit.” That does nothing. If they would’ve said “we will work hard to improve our software to read every language,” I (and millions of other Americans) would be happy.

Until that happens, who cares about increasing the daily limit when we get limited in deposit money to begin with?

I’m sharing this story because I think I am not the only who has gone through this.

Thanks for your awesome attention and interest.

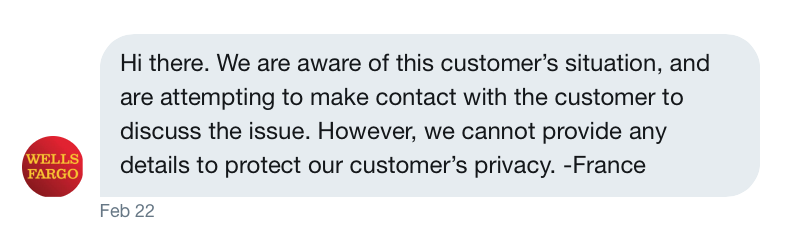

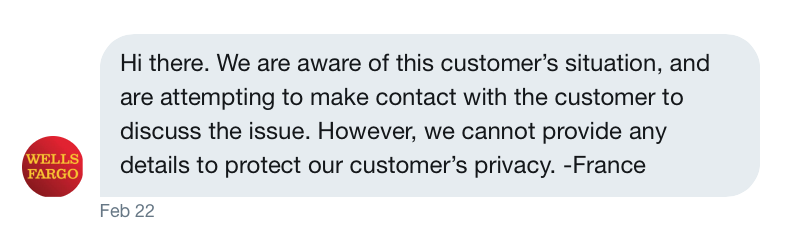

Editor’s Note: We did reach out to the Wells Fargo’s customer service Twitter about this story and this is what the bank told us on February 22 via Twitter DM. We did let Wells Fargo know that the customer would be writing about her experience at the local branch.

Hmm what’s so insulting about asking you to speak and write English in America?

The conversation was in English and the actual post is written in English.

First, the check is an American check, written and drawn from an account that is in Puerto Rico – which is a territory OF the United States of America. Second, considering the level of global business and global family remittances, in the trillions of dollars, surely any major U.S. bank that wants to make money from… you know, banking?… surely has systems in place so that their clientele can do business (including receive checks from!) globally, and they as a bank can therefore make their money from serving clients with business and family ties everywhere from Germany to Senegal to Thailand to Argentina, etc. I can’t imagine any major bank actually saying to themselves, “Hmm, there’s billions in global banking fees waiting for us out there! Who cares, we don’t need the money.”

sue!

My God! This is not sense. For any check processing system it doesn’t matter the check language. What the system reads is the routing number and the account number, and those are the same in English or Spanish. That was a discrimination scene, that I had see in the past.

Ive encountered similar situations with ignorant people. Wellsfargo has terrible customer service and tbeir sustem is always hsbing issues. Thsts why im moving to Chase.

Good thing, Chase has people employed that can’t spell as well.

I have been with wells fargo for over 10 years and their policies have changed not to benefit the customers but to benefit their business….I made a decision to find another bank.I will not be a customer of theirs any longer…I even put it on social media and told friends and family how terrible their customer service is…

So long wells fargo, y’all suck!!!

I truly understand because they charge me 12.50 to transfer money from saving account to my checking which my working check was been deposit into my account I was highly upset! I’m transferring over to another bank. Wells fargo stating they reestablish 2018 but all they have done is cause problems.

I’ve worked in banking for the post 16 years. I’ll alsk everyone this– does anyone know why a US bank might not accept a check written in Spanish/Portuguese/Mandarin/Japanese/Swedish/Russian/French/etc?

And this is from the bank that extortion and stole millions of dollars from their customers? I had a similar situation when my grandmother came to visit me. In that case, BofA, charged exchanged rate on a check drawn on us dollars just because the check was written in Spanish. Go figured

WF has made me more and more suspicious with every shady behaviors over the years, but this is the last straw for me. Changing my direct deposit and finally ditching them.

I believe this story is missing the most important point of all – The United States doesn’t have an official language. There is no obligation for anyone (including legal entities) to communicate specifically in English. She has a discrimination case on her hands. She needs to sue the bank. And I dislike Wells Fargo very much, anyway. This just adds fuel to the fire.

My wife deposited a alstate insurance check and asked for 2000 cash and they gave it to her. Then hours later they say they put a hold on a 20,000 life insurance check and the 2,000 gave to,her is considered a bounced check. It was supposed to be a auto deposited but they instead mailed it when it was noted to be deposited

It’s an insurance check, legal and valid, to deposit in a county with no official language, where the most spoken language is English and the second one is Spanish! Get a grip Wells Fargo or a lawsuit for discrimination and bad banking practices.

Why would you want a check written in Spanish when you are depositing it to begin with? The computer system is not bilingual. May I suggest next time to just do it the American way, get the check cut in English. The bank asked for you to get a check in English, what is the problem? It will be a few more days before you get your entitlement. Is that what the problem is, you are entitled for the policies to be changed just for you? I’m afraid not. As far as the process, you are to return the one check for the Spanish Check to be voided. Why would you ever think differently. The problem all seems to boil down to ignorance on your part, not Wellsfargo. Another instance of claiming prejudice when it all boils down to policies.

I have never known a bank in Greece, France, Italy or even Mexico to turn down a check written in English. As long as it’s written in dollars, they seem to understand it just fine.

Outrageous! This is soo easy: drop bigoted, prejudicial Wells Fargo and move to a customer oriented bank. I do all my banking, from Puerto Rico, with Bank of America. Never an issue.

As a person who works 15 years for a bank, as long as the routing number, account number and name are legible, there should be no reason for not cashing the check. The language on the check is irrelevant as that is not the information that is used to process the check. All they need to do is manually override the system.