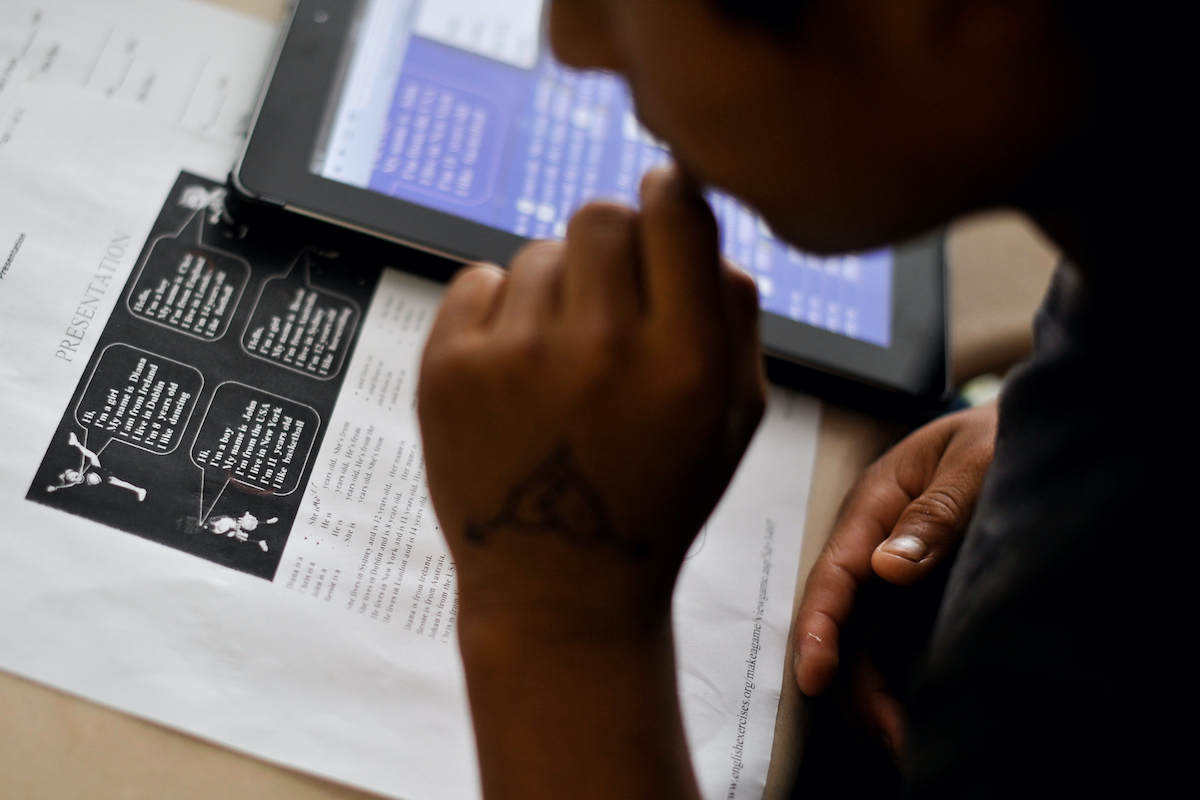

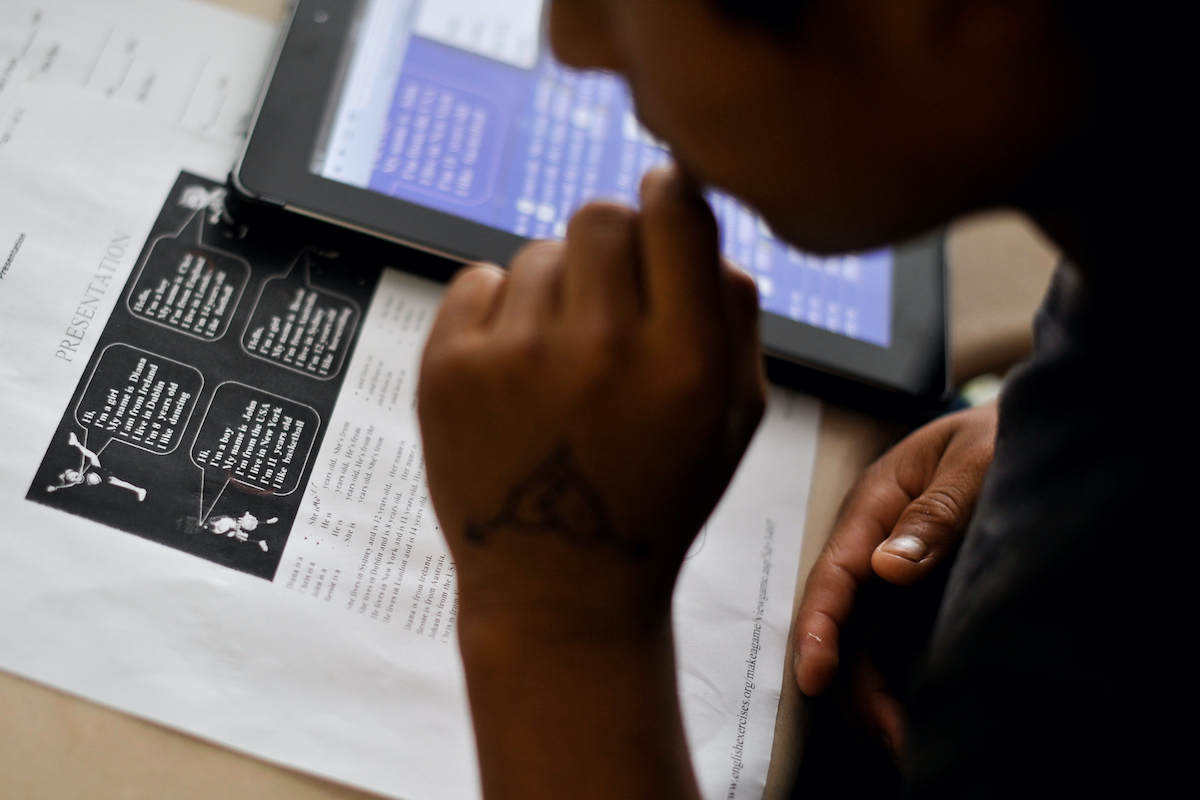

(Photo by AP Photo/Emily Varisco)

By Yanely Espinal

College enrollment was down nearly six percent in the spring of 2021 compared to the previous year. Decreased enrollment for Latinx students is particularly unsettling because it had been steadily rising before the pandemic. September was both National College Savings Month and the start of Latinx Heritage Month, which presented the perfect opportunity to have this critical conversation.

Latinx students dropped out of college for many reasons, most of which were related to the pandemic. Their families were more vulnerable to economic hardships during 2020 compared to other ethnic groups. This has been attributed largely to the fact that Latinx Americans are overrepresented in the service and restaurant industries, which were hardest hit by COVID-19.

As a Latina who did manage to graduate from a traditional, four-year college, my advice for Gen Z is to devote time to researching and planning out how you’ll pay for college before applying. If you decide college isn’t right for you, then make an alternative plan right away!

Being Gen Z means you grew up watching the student loan debt crisis unravel, and it has likely led you to develop debt aversion. It’s extremely important to maximize free aid and apply for as many scholarships as possible before borrowing money for college.

We must also note, though, that the general guideline of aiming to graduate in debt equal to or less than one year of earned income in your desired field of study is still solid financial advice. Data shows that with a college degree you earn close to a million dollars more throughout your career.

It helps to practice paying for and attending college before you actually do it. Thanks to Next Gen Personal Finance (NGPF), a nonprofit where I serve as director of educational outreach, you can play a free online game that helps you do just that!

The langauge barrier presents yet another hurdle for many Latinx families when navigating the college process. Fortunately, the free activities and games on NGPF’s website are also available in Spanish. These resources can help anyone find scholarships or even explore alternatives to four-year college if pursuing the traditional educational pathway isn’t your preference.

Our school systems tend to emphasize traditional careers and college. There needs to be more discussion about alternative pathways that exist such as trade school, internships or apprenticeships, joining the workforce, entrepreneurship, taking a gap year, or joining the military. This needs to be part of the school curriculum. There are a number of careers within the armed services, for example, which most people have little to no knowledge of, and the military offers young enlistees substantial assistance with education.

For anyone planning to attend college, the first thing to do is become familiar with Free Application for Federal Student Aid (FAFSA) which opens each year on October 1st.

We need to do better at making this information available and understandable to the Latinx community. Completing a FAFSA application is the only way to know how much federal financial aid you qualify for, based on your family’s financial situation. Federal aid may include low-rate student loans that need to be paid back with interest, but for most people it starts with federal grant funding that does not need to be paid back.

Many students struggle to set aside money for 529 plans early on because of other financial obligations such as sending remittances to family members in their home country. Even though poverty rates in the Latinx community were at a historic low before the pandemic, we continue to be disproportionately represented among the nation’s poor.

It’s time we step up and take action to close these gaps, and being able to successfully navigate the post-high-school years through financial literacy is an important step toward that goal!

***

Yanely Espinal is director of educational outreach at Next Gen Personal Finance and a graduate of Brown University.