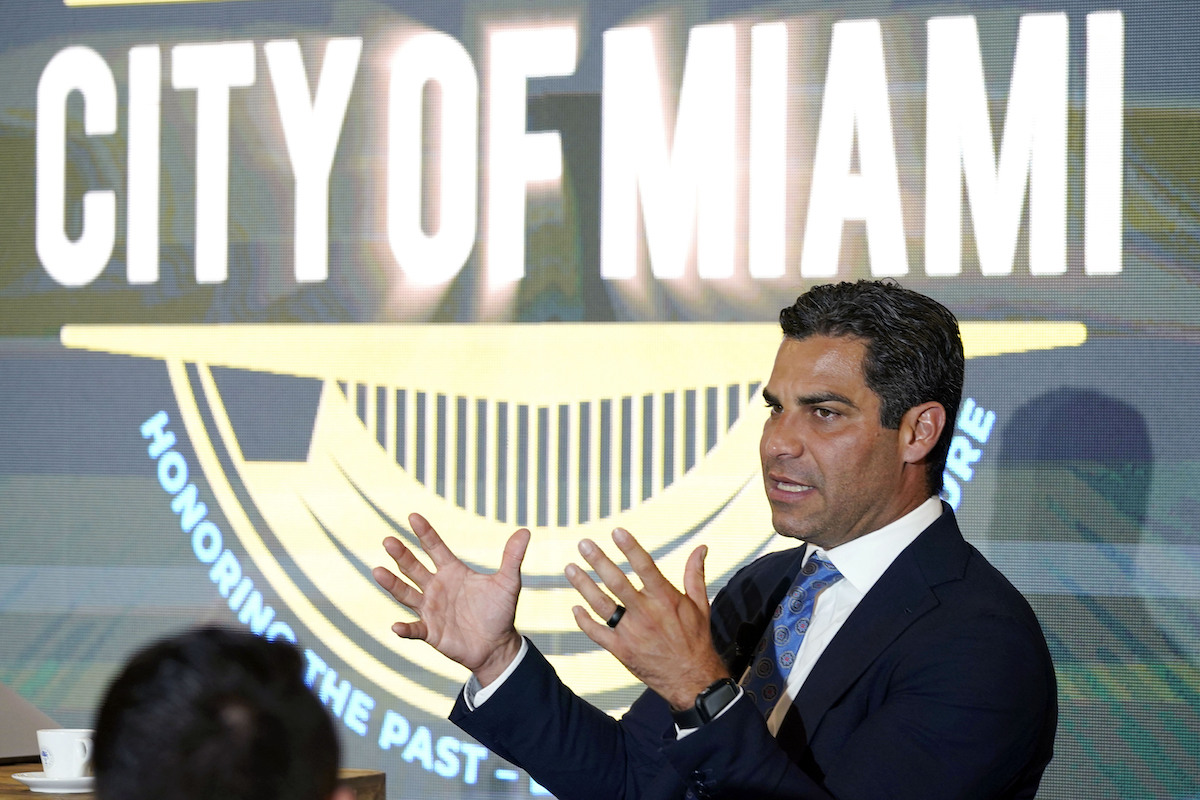

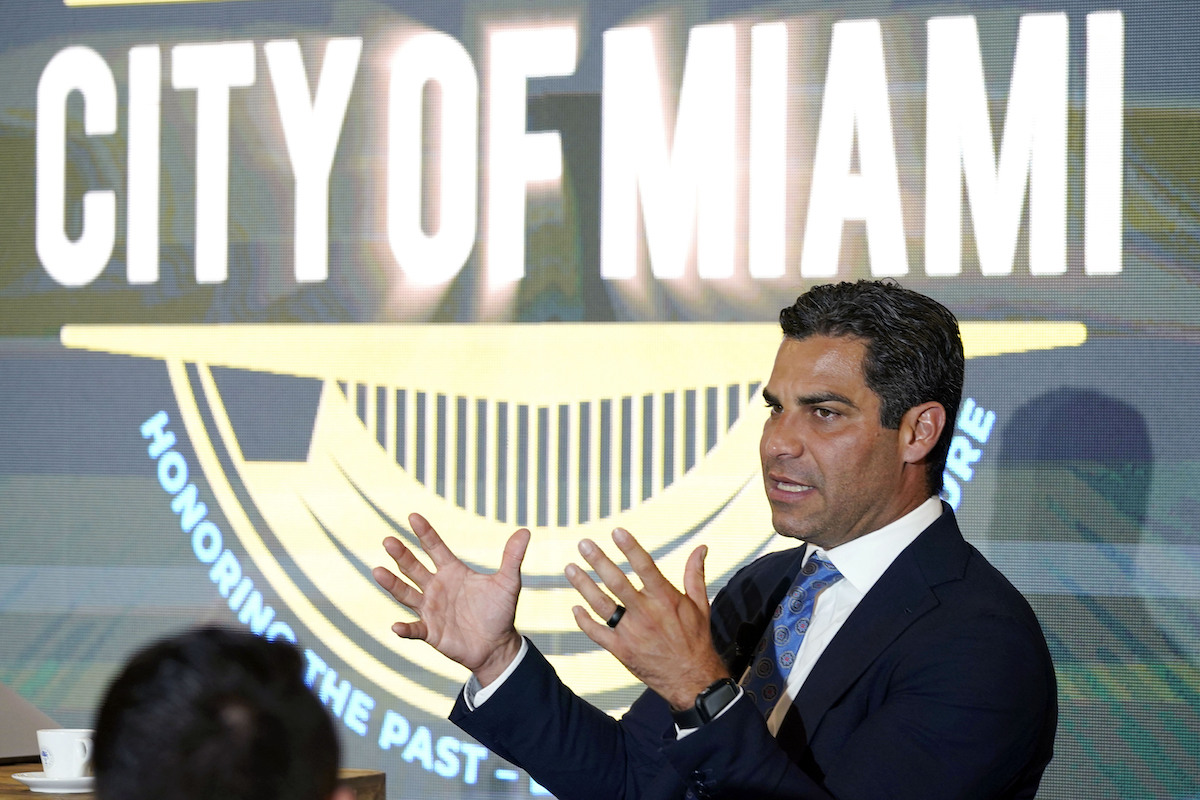

Miami Mayor Francis Suarez hosts a talk with local artists at the Bakehouse Art Complex, on the emergence of non-fungible tokens (NFTs) in the art world, July 27, 2021, in Miami, Fla. (AP Photo/Lynne Sladky. File)

MIAMI — Late last year, I saw Miami Mayor Francis Suarez at a cafe in Coral Gables. Under Suarez’s tenure, the City of Miami has become the most unaffordable housing and renting market in the nation. As a resident of the city, I felt compelled to ask him about the housing crisis gripping Miami.

“Mayor, we need less bitcoin and more affordable housing. What are you doing to keep people in their homes?” His answer left me speechless. He simply turned to me and said, “MiamiCoin is worth $16 million.”

It’s been a few years now since Suarez has been singularly focused on pushing cryptocurrency to the detriment of his other responsibilities as mayor. At the recent Bitcoin Conference hosted in Miami Beach, Suarez articulated what he calls the “vision for Bitcoin America 2024,” calling for the next president of the United States to be “pro-Bitcoin” and for Bitcoin to be integrated into “every aspect of our society.”

Perhaps the most infamous crypto scheme associated with Suarez is MiamiCoin, which has lost nearly all of its value since receiving the mayor’s endorsement, plummeting 95% from its peak last year to now fractions of a penny.

So what is MiamiCoin? The first thing to understand is that it’s not actually owned by the City of Miami but by a company called CityCoins and it runs on something called the Stacks protocol, which generates MiamiCoin when people mint and send Stacks tokens into a smart contract.

What does that mean? One of the best explanations is detailed by tech expert Mike Bloomberg, who we recently had the pleasure of talking to about city coins. He compares the process of acquiring MiamiCoin to a raffle in which CityCoin users bet Stack tokens for a chance to create MiamiCoin. If they do, and the odds are unknown, 30 percent is automatically sent to the City of Miami’s digital wallet and the remainder is kept by the user per an agreement between Miami and CityCoins.

https://www.youtube.com/watch?v=dM5duDuyxYk&t=7s

CityCoins is not only focused in Miami. Other cities like New York and Austin have explored similar cryptocurrency partnerships but none with the same level of enthusiasm as the Magic City. That’s largely because of Suarez’s endorsement of the project and his promotion of MiamiCoin to residents and investors.

Media outlet Quartz obtained emails between representatives of CityCoins and Suarez’s staff showing that the mayor’s media appearances promoting MiamiCoin were creating problems for the project and could cause regulatory red flags:

“We need to get an hour with the Mayor for a comms training session on CityCoins and MiamiCoin. It’s great that he is doing press but he would greatly benefit from an hour session with Patrick on how to best communicate the project. There are a few regulatory wires the Mayor has tripped in recent interviews and it’s really important for the sustainability of the project that he is better prepared. We really care about the Mayor and his role in making MiamiCoin a success—it’s critical that we get time with him as soon as possible.”

In one appearance for Fox & Friends, Suarez claimed that the revenue generated by the City of Miami’s stake in Miami Coin would be given “as a “dividend to all of our residents in Bitcoin” through a “digital wallet.”

The Mayor of Miami @FrancisSuarez stakes Miami coin and uses the profits to eventually eliminate taxes for residents. This is actually WILD. Good work Mayor Francis Suarez!

.

Credit to: @Coachjv_ pic.twitter.com/wa4O4y77Kq— The Invested Captain (@CaptainInvested) February 12, 2022

Towards the end, Suarez makes the eyebrow-raising claim that “if this thing continues to grow, there is a world under which we can actually run the city without taxes.”

Here’s Miami Mayor @FrancisSuarez saying on Fox & Friends that City of Miami would possibly no longer need taxes to run and that residents were going to get a “Bitcoin dividend” from Miami’s stake on MiamiCoin.

The cryptocurrency has lost 95% in value since and is now worthless. pic.twitter.com/vllCY0Vrw1

— Thomas Kennedy (@tomaskenn) June 7, 2022

When confronted later by Fox News host Neil Cavuto on MiamiCoin’s sharp loss of value, Suarez once again doubled down by again promising to distribute part of the yield from Miami’s stake in MiamiCoin to residents, something that he called “very innovative” while claiming that he doesn’t obsess “over the price” of MiamiCoin.”

If that sounds too good to be true, it’s because it is. I’m a Miami resident myself and I can personally tell you that I am still waiting for both my “Bitcoin dividend” and the day in which Miami no longer needs tax money to run.

So how could such an obvious grift by a guy that looks and sounds like he is literally selling you snake oil go on until it inevitably imploded? The mainstream media and their rosy coverage of Suarez and his crypto schemes have their share of the blame.

A Washington Post article from September 2021 provides an embarrassingly uncritical and shallow portrayal of MiamiCoin, stating that Suarez has a plan to transform the city into the world’s “cryptocurrency innovation hub” and presenting his claim that it could result in a “metropolis free from taxes” as a “lofty idea” that goes unchallenged throughout the piece. It reads like a press release by Suarez’s team with no questions regarding sustainability, conflicts of interest, or regulatory red flags.

Miami residents are facing real issues. As I said before, we have the most unaffordable housing and renting market in the country. Our infrastructure is lackluster and our streets severely flood when our sewage and drainage systems are stressed by a normal rainstorm.

Drone shots showing #flooding in Little Havana and downtown #Miami #FlWx #flood pic.twitter.com/laH5ARNvth

— WxChasing- Brandon Clement (@bclemms) June 4, 2022

The public transportation system is almost nonexistent and not a viable option for the thousands of workers who live in this city. Instead of focusing on addressing these basic but challenging problems, Suarez is focused on “innovation” through cryptocurrency schemes that never materialize into anything substantial for long-time Miamians and instead only serve to increase his public profile through appearances at tech events.

There is an obsession by mayors with the concept of innovation as a short-term public relations gimmick. Crypto companies like CityCoins provide an opportunity for mayors to pretend they are innovative while ignoring actual issues that have no simple solutions. In the case of cryptocurrencies, it’s even more dangerous because of their extreme volatility and the fact that they aren’t backed by anything except investor confidence.

In the case of MiamiCoin, all the red flags have been proven right. As previously stated, the currency has lost over 95% of its value and is now pretty much worthless. In the process, investors and residents have lost money and there are calls for regulators to step in and investigate Miami’s political leadership and their dealings with shady crypto companies like CityCoins.

Francis Suarez is now trying to have it both ways, still defending MiamiCoin while saying that he never “pushed for anything” when asked if other places should adopt CityCoins. To anyone who has been paying attention, the record is clear, Suarez was neck-deep in advocating and promoting MiamiCoin, and in the end, we don’t have much to show for it except an increasingly unaffordable city and a whole bunch of people who lost a lot of money.

***

Thomas Kennedy is an elected Democratic National Committee member representing Florida. Twitter: @tomaskenn

[…] Source link #Miamis #Bitcoin #Mayor #Fails #OPINION […]

[…] a substitute of addressing any of those precise issues, Suarez has been singularly targeted on pushing cryptocurrency to the detriment of his different obligations as mayor. At a latest Bitcoin convention hosted in […]

[…] of addressing any of these actual problems, Suarez has been singularly focused on pushing cryptocurrency to the detriment of his other responsibilities as mayor. At a recent Bitcoin conference hosted in […]

[…] of addressing any of these actual problems, Suarez has been singularly focused on pushing cryptocurrency to the detriment of his other responsibilities as mayor. At a recent Bitcoin conference hosted in […]

[…] of addressing any of these actual problems, Suarez has been singularly focused on pushing cryptocurrency to the detriment of his other responsibilities as mayor. At a recent Bitcoin conference hosted in […]

[…] a substitute of addressing any of those precise issues, Suarez has been singularly targeted on pushing cryptocurrency to the detriment of his different obligations as mayor. At a current Bitcoin convention hosted in […]

[…] of addressing any of these actual problems, Suarez has been singularly focused on pushing cryptocurrency to the detriment of his other responsibilities as mayor. At a recent Bitcoin conference hosted in […]

[…] when making selections. Up till the latest crypto-market crash, he was largely identified for his obsession with cryptocurrencies and for peddling a grift-coin referred to as “MiamiCoin,” which I’ve written about prior to […]