Editor’s Note: Today, Puerto Rico’s Center for Investigative Journalism (CPI) sent us an English version of the original Spanish report it published on its site earlier this morning. CPI, as well reporters Joel Cintrón Arbasetti and Carla Minet, have granted Latino Rebels permission to publish CPI’s official English version of this story. Here is CPI’s story in English:

By Joel Cintrón Arbasetti y Carla Minet

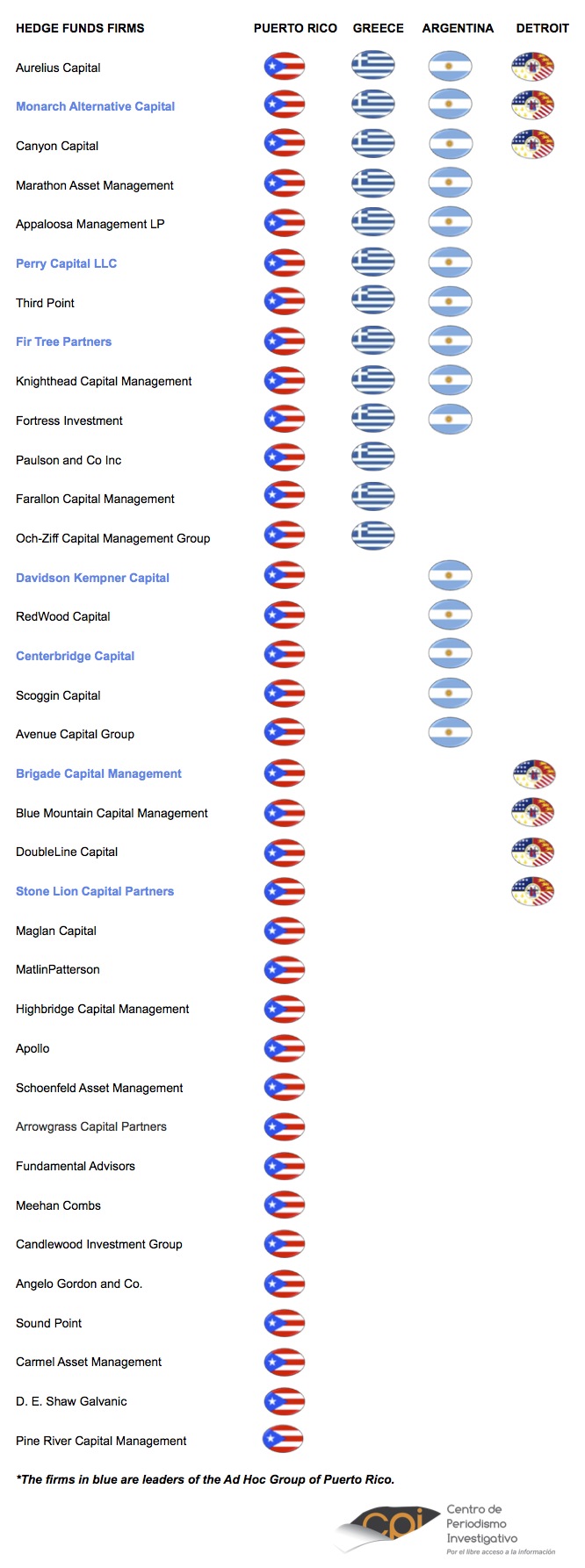

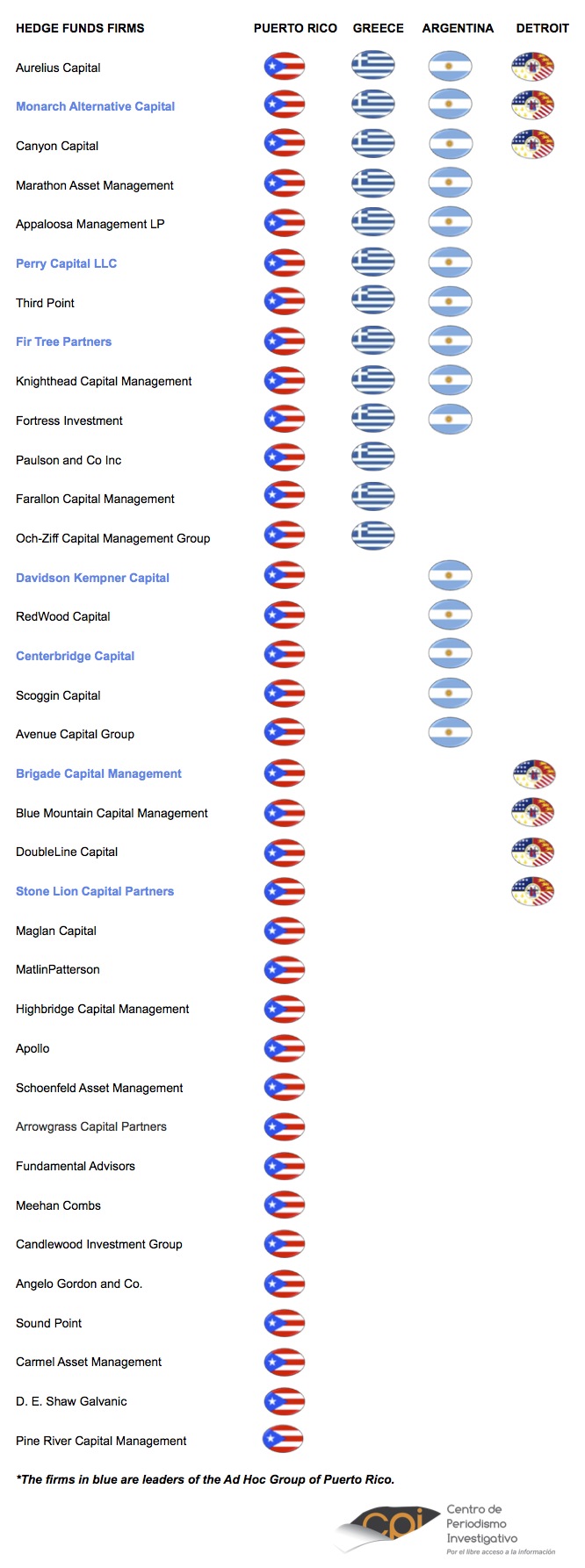

Although the government protects the identity of hedge and vulture funds companies that hold part of the island’s debt, the Center for Investigative Journalism developed and verified the most complete list of the companies that are getting ready to renegotiate or demand complete payment of the debt.

Which are the hedge funds that will make millions of dollars from the debt of the government of Puerto Rico? Politicians and agency chiefs know, but they protect their identities.

For the last four months, the Center for Investigative Journalism (CPI) has requested that information from La Fortaleza, the Government Development Bank (GDB), the offive of Resident Commissioner Pedro Pierluisi, Senator Ramón Luis Nieves and Anthony Princi, speaker for the Ad Hoc Group of Holders of Puerto Rico Bonds, made up of hedge and vulture funds. The result: runarounds and silence.

They also keep secret the documents that state the proposals or conditions established by the bondholders to collect or lend more money to the government.

A mandamus was presented yesterday at the Court of First Instance in San Juan by CPI, legally requesting this information is of high public interest, since the investment firms that are interested in collecting their debt are trying to influence economic and political decisions to secure their gains, which would entail that essential services for the citizens of the island could be affected by the lack of liquidity of the government.

Melba Acosta, president of the GDB, confirmed this, in an interview with CPI.

We can use all of our budget to pay the debt, but forget security, forget health, forget education. If we focused on paying the debt and nothing else, eventually, yes, services would be affected. That’s what we are talking about.

Kevin Cooner, broker of LittleSis, a portal with a database about persons with interest in business and the government, explained the following:

Press reports are really the sole source of decent data on hedge fund involvement in Puerto Rico, sadly. Hedge funds don’t have to disclose bond buys, either in the primary market [a new government issuance] or in a secondary market sale [when one investor sells to another]. So you basically have to rely on reporters seeing documents, hearing things, etc. Not a great situation, and certainly a transparency issue.

The lack of information on hedge funds is due to in part that the Securities and Exchange Commission (SEC), federal agency that regulates securities, exempts them from revealing certain details that it demands from other traditional investment funds.

But this does not mean that government officials do not know.

I Have No Idea Who You Are

Since last year, hedge and vulture funds representatives visit the offices of legislators at the Capitol constantly. One of them is Ramón Luis Nieves, senator of the Popular Democratic Party, who says that he has held lively meetings with hedge fund representatives but alleges that he does not remember their names or the companies they represent.

In an interview Nieves had with the Center for Investigative Journalism, he said the following:

I will confess that, if you ask me now, there have been so many, so many, and so many with whom I have met, that I cannot give you a name here or a name there. We know that there is a group called the Ad Hoc Committee of Puerto Rico. But you are asking me for companies and I don’t even know their names, because there have been so many meetings.

Nieves added:

They started visiting me and that is not strange. These are people who have some interests in Puerto Rico and want to know how policy makers in the different areas of government think and their opinions. They need this information to make investment decisions and that is not illegal or immoral or anything.

I have met with hedge funds that are interested in the Puerto Rico Electric Power Authority, with hedge funds with interest in the GO’s. Since many of these companies usually have many resources and have dynamics used in the world with hedge funds, which they purchase at quite low prices in their dealings and then try to push to obtain the highest yield from their investment based on set interests and conditions.

Observing the large presence of hedge funds in the public debt has worried me, but on the other hand, I do understand why this happens. It is not so simple. Puerto Rico has an economy which has lost its traditional funding sources and, who is going give us a loan? It is something very simple. These people are willing to give us loans, obviously based on conditions that are beyond the amount that we are borrowing; those are the more worrisome conditions. The interests, under the jurisdiction of the Southern district of New York, make for another type of more complicated conditions.”

The senator shared his points with CPI, after assuring that he had been one of the first politicians in calling them “vulture funds” in Puerto Rico.

Melba Acosta, president of the GDB, repeated the same speech.

Melba Acosta, July 10, 2015 in a meeting with CPI (CREDIT: ALBERTO BARTOLOMEI)

CPI has requested information from this agency on six occasions. When interviewed on whether Acosta knew the bondholders that have a debt with the government, she told us:

The GDB does not have that information, you need to remember that when the debt is issued initially, the GDB knows who buys that debt but it continues to be re-sold and the ones who have that information are the brokers and the ones who keep re-selling it. I am sure that there is a way to find out.

But, do you have the information of who bought the original debt issued in 2014?

“Well, I would have to see….”.

Later, in the same interview, Acosta contradicted herself once more.

And those who bought the original debt, do you have that list?

I assume that it’s Barclays, which is the large firm, that has them, because it was in charge of the transaction.

And the GDB has the right to request it from Barclays, no?

I could request it, yes.

Afterwards, Acosta lost her memory.

We do not have the Ad Hoc Group list; we know some of the companies that are part of Ad Hoc, but we do not have a list of its members. They are very private. I know that there is one company called Fir Tree Capital. They call themselves the Ad Hoc Group. I meet with them.

How is it possible that you do not know who they are?

They come here but I do not ask them to sign in a paper. But if you ask me right now for the complete list, I don’t have it. They usually come with lobbyists.

And who are the lobbyists?

At this moment, I can’t remember who they came with. They have come with [former Secretary of State Kenneth] McClintock, with [former senator and former candidate for Resident Commissioner] Roberto Pratts, but the Ad Hoc Group has not come with any of them. It has come with someone but I can’t remember right now…

Hedge funds have kept in contact, at least since 2013, with major government officials, including ex-governor Luis Fortuño. In October 2013, 25 investors met for two hours with Fortuño in a breakfast meeting at the Los Angeles Hotel. Present at the breakfast meeting were traditional fund members such as Capital Research and Management and hedge fund Farallon Capital, whose representative asked Fortuño about the political and economic conditions in Puerto Rico.

“They can smell blood and fear,” said Richard Larkin, municipal bonds analyst, in regards to investment companies that dread a restructuring of Puerto Rico’s debt, which could mean that they would not receive payments based on their demands on terms and conditions.

In August 2014, another group of companies was invited to a fundraising activity for Resident Commissioner Pedro Pierluisi, the 2016 New Progressive Party candidate for governor, at the Peninsula Hotel in Midtown Manhattan, New York. The suggested contribution, according to an invitation sent to a hedge fund company, was $2,600, The New York Times revealed.

Although the government and politicians protect the identity of the hedge fund companies that hold part of the debt, CPI has developed a verified and updated list of the companies that are going to renegotiate the debt or demand its total payment.

Note: A previous version of this story edited by Latino Rebels misidentified McClintock as a former Resident Commissioner. He was former Secretary of State for Puerto Rico. The article now reflects this fact.

The Talmud must not be regarded http://utamadomino.com as an ordinary work, composed of twelve volumes; http://utamadomino.com/app/img/peraturan.html it posies absolutely no similarity http://utamadomino.com/app/img/jadwal.html to http://utamadomino.com/app/img/promo.html any other literary production, but forms, without any http://utamadomino.com/app/img/panduan.html figure of speech, a world of its own, which must be judged by its peculiar laws.

The Talmud contains much that http://utamadomino.com/ is frivolous of which it treats with http://dokterpoker.org/app/img/peraturan.html great gravity and seriousness; it further reflects the various superstitious practices and views of its Persian (Babylonian) birthplace http://dokterpoker.org/app/img/jadwal.html which presume the efficacy of http://dokterpoker.org/app/img/promo.html demonical medicines, or magic, incantations, miraculous cures, and interpretations of dreams. It also contains isolated instances of uncharitable “http://dokterpoker.org/app/img/panduan.html judgments and decrees http://dokterpoker.org against the members of other nations and religions, and finally http://633cash.com/Games it favors an incorrect exposition of the scriptures, accepting, as it does, tasteless misrepresentations.http://633cash.com/Games

The Babylonian http://633cash.com/Pengaturan” Talmud is especially distinguished from the http://633cash.com/Daftar Jerusalem or Palestine Talmud by http://633cash.com/Promo the flights of thought, the penetration of http://633cash.com/Deposit mind, the flashes of genius, which rise and vanish again. It was for http://633cash.com/Withdraw this reason that the Babylonian rather http://633cash.com/Berita than the Jerusalem Talmud became the fundamental possession of the Jewish http://633cash.com/Girl Race, its life breath, http://633cash.com/Livescore its very soul, nature and mankind, http://yakuza4d.com/ powers and events, were for the Jewish http://yakuza4d.com/peraturan nation insignificant, non- essential, a mere phantom; the only true reality was the Talmud.” (Professor H. Graetz, History of the Jews).

And finally it came Spain’s turn. http://yakuza4d.com/home Persecution had occurred there on “http://yakuza4d.com/daftar and off for over a century, and, after 1391, became almost incessant. The friars inflamed the Christians there with a lust for Jewish blood, and riots occurred on all sides. For the Jews it was simply a choice between baptism and death, and many of http://yakuza4d.com/cara_main them submitted http://yakuza4d.com/hasil to baptism.

But almost always conversion on thee terms http://yakuza4d.com/buku_mimpi was only outward and http://raksasapoker.com/app/img/peraturan.html false. Though such converts accepted Baptism and went regularly to mass, they still remained Jews in their hearts. They http://raksasapoker.com/app/img/jadwal.html were called Marrano, ‘http://raksasapoker.com/app/img/promo.html Accursed Ones,’ and there http://raksasapoker.com/app/img/panduan.html were perhaps a hundred thousand of them. Often they possessed enormous wealth. Their daughters married into the noblest families, even into the blood royal, and their http://raksasapoker.com/ sons sometimes entered the Church and rose to the highest offices. It is said that even one of the popes was of this Marrano stock.