By Luis J. Valentín Ortiz and Joel Cintrón Arbasetti

Versión en español aquí.

“Started engaging with the creditors yet?,” asked Ted McCann, then adviser to House Speaker Paul Ryan (R-Wisconsin), in a March 21, 2017 email sent to Carlos García, a member of Puerto Rico’s federally-appointed Fiscal Control Board.

Shortly after, García, a former president of the commonwealth’s Government Development Bank (GDB) and whose appointment to the board was pushed through Ryan’s office, replied:

“Yes, a lot of focus on GO/Cofina controversy. Each group stepping up their rhetoric. Board pressing on for meaningful progress. Challenge is the limited projected Primary surplus available in the first 10 years for debt service. Should know more by next week.”

Later on that day, McCann replied back:

“None of the major creditor groups (including Oppenheimer, Franklin, Goldman, Ambac, etc.) I have talked to have said you guys have been in contact. What’s the discrepancy here?”

“I don’t know but I will find out,” García said a few hours later.

Dozens of examples like these show how the U.S. government exercises a colonial power relationship over Puerto Rico through the Fiscal Board—according to the more than 5,600 documents, letters and emails obtained by the Center for Investigative Journalism (CPI), which sued the board a year and a half ago to gain access to this public information. The initial document delivery comprises of communications between the board and Congress, the White House and federal agencies since the beginnings of the federally-appointed entity in the summer of 2016 until May of this year.

Either from a congressional office or a federal agency, documents obtained show continuous requests for information and meetings made to members and officers of Puerto Rico’s Fiscal Board, who usually attend to them almost instantly. There are also discussions, warnings, “recommendations” and questions over issues such as the approval of fiscal plans, debt negotiations, Puerto Rico’s political status, the future of the government-owned Electric Power Authority (PREPA), the operations of the Fiscal Board and federal funds allocated for Puerto Rico, including recovery money after Hurricanes Irma and María.

Congress

In a March 29 letter sent to board Chairman Carrión, GOP Rep. Rob Bishop (R-Utah), who chairs the House Committee on Natural Resources, slammed the Fiscal Board for the lack of agreements between the commonwealth government and its creditors, as well as for the unsatisfactory implementation of PROMESA. The committee is in charge of matters related to Puerto Rico.

That same day, Andrew Vecera, who works for the committee chaired by Bishop, wrote to Carrión:

“José, I hope you are doing well (and apologies for burdening you with more work). Attached is a letter from [Committee] Chairman Bishop regarding the revision of the Fiscal Plans. We wanted to reiterate the power the Board has in regards to the Fiscal Plans to push back on the Governor’s [Ricardo Rosselló] recent actions. It is a bit aggressive… Please let me know if you have any questions, and in the alternative, I do hope you have a happy Easter!”

A few hours later, the Fiscal Board’s chairman replied:

“Thank you Andrew. It has been an interesting couple of days. I acknowledged receipt of the letter, and indeed see it as strong and in my view, on the whole, helpful to the Board, and what needs to be done. I understand the rationale of creditor component of the letter, but here my only comment would be, that we are actively engaged multiple fronts to come to an agreement, but it takes good will from multiple parties. Nonetheless we understand this is essential to our mandate and will hunker down. Hopefully after certification [of the fiscal plans] on the 19th and 20th, that will speed up.”

Just over three months earlier, in December 2016, Carrión received from Rep. Bishop’s office a confidential copy of a letter that the congressman would send to the Board later. As chairman of the House Committee on Natural Resources, Bishop has been involved with Puerto Rico issues since the conception of the federal PROMESA law. Last week, he began to push for a ‘yes-or-no’ statehood plebiscite for Puerto Rico, despite he didn’t act on the statehood proposal that had been pushed for almost two years by the island’s non-voting representative at Congress, Jenniffer González, a Republican.

“As we discussed today, I have attached a confidential draft of a letter the Committee on Natural Resources intends to send to you as Chair. Please feel free to share the draft with the other Board members, but otherwise please keep confidential. […] Please let me know if this letter will cause any difficulties for the Oversight Board,” Bill Cooper, an adviser to Rep. Bishop, wrote to Carrión.

Cooper, one of PROMESA’s intellectual authors and reportedly considered as a possible executive director of the Fiscal Board, shows up regularly in the communications obtained by the CPI. He left Congress in 2017 to manage a new office opened in Washington by McConnell Valdés, a Puerto Rican law firm. Last August, Cooper was appointed by President Trump as an adviser in the U.S. Department of Energy and is already working once again on issues related to Puerto Rico.

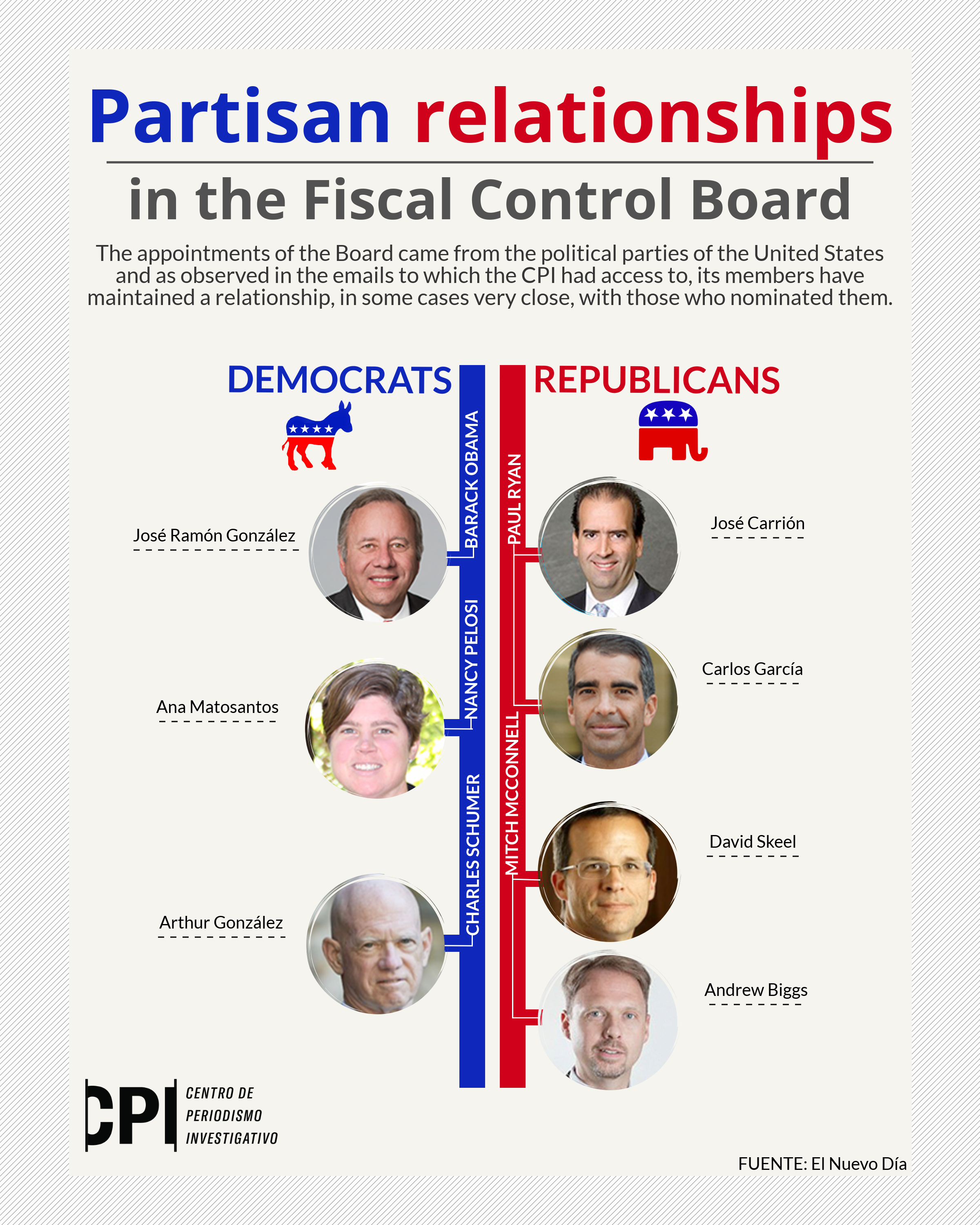

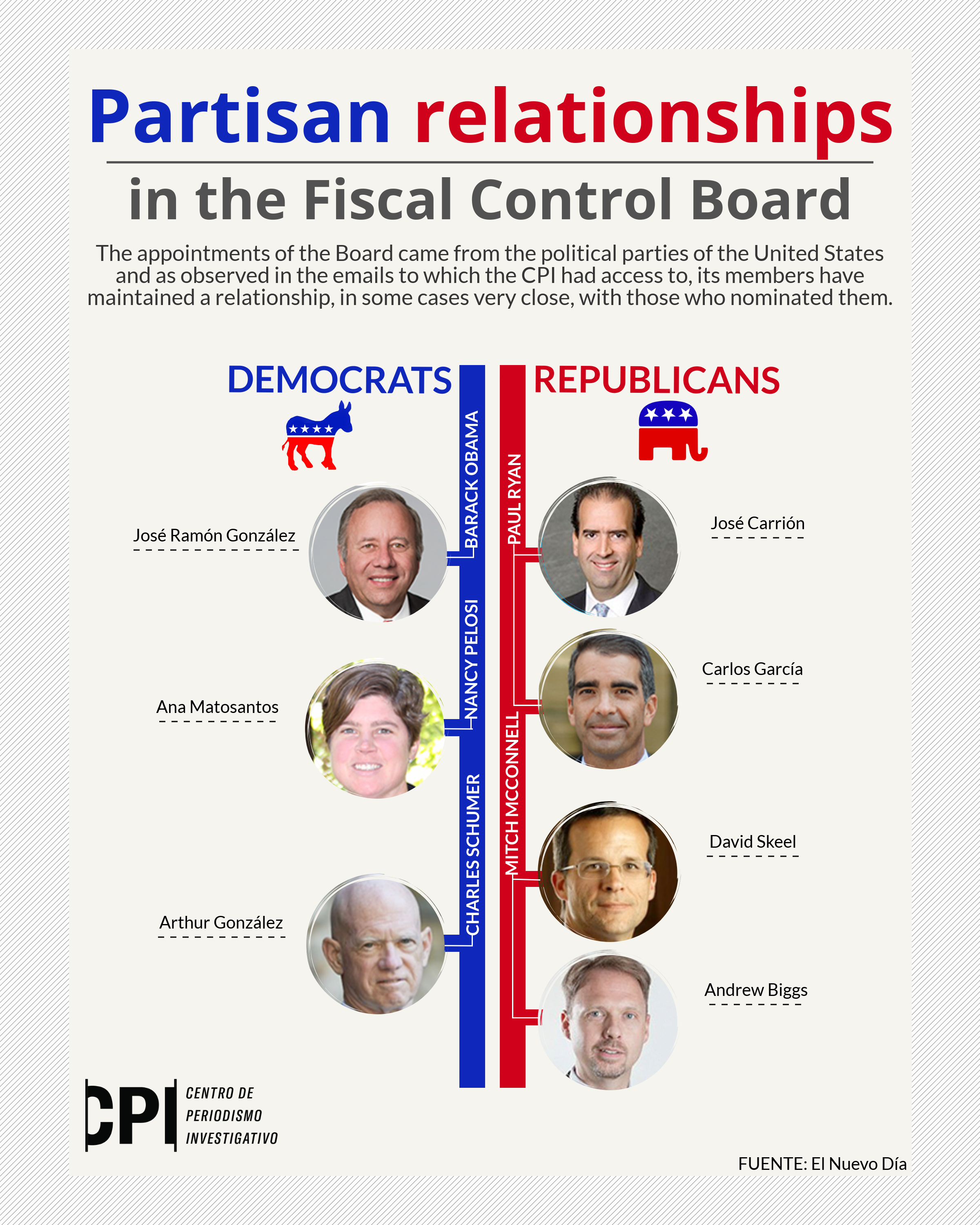

From the GOP side, members Carrión, García, Andrew Biggs and David A. Skeel, Jr., are frequently contacted by the offices of Speaker Ryan and Bishop, as well as Sen. Orrin Hatch (R-Utah) and Senate Majority Leader Mitch McConnell (R-Kentucky). As chairman of the Senate Finance Committee, Hatch actively participated in the drafting and approval of PROMESA and its fiscal board. He has been one of the most vocal members of Congress on issues related to Puerto Rico’s fiscal and economic crisis such as tax reform and federal health funds.

Puerto Rico’s Fiscal Board also receives direct supervision from the other side of the aisle. In the case of Ana Matosantos —one of three Democratic appointments— she keeps direct communication with the office of Rep. Nydia Velázquez (D-New York).

“This blaming/credit claiming game is ridiculous,” wrote Rosanna Torres, an adviser to Rep. Velázquez, in reaction to a news story that quoted Governor Ricardo Rosselló Nevares saying that the board had not communicated with him after Hurricane Irma passed through the island.

“Agreed. Especially given the circumstances. Did you see our release? I thought it was a just the facts. I don’t know how we end up in this bickering again?,” Matosantos replied.

In addition, Board members and Congress share information that is out of the public domain. An example of this were comments made by the board’s financial consultants to Puerto Rico’s fiscal plans, which the entity shared with Bishop’s office, but warned to keep confidential.

The board told CPI that its decisions respond “only to the mandates of PROMESA and Puerto Rico’s best interests.” The entity confirmed it communicates “regularly with multiple interested parties, including congressmen and officials of the Federal Government, whose public policies and actions have a significant impact on the economy of Puerto Rico.”

An Autonomous Entity?

PROMESA, a law signed in 2016 by President Barack Obama, establishes that the Fiscal Board “shall not be considered to be a department, agency, establishment or instrumentality of the Federal Government.” It is to be within the commonwealth government, yet autonomous.

Is the board autonomous from the U.S. government? The CPI asked both the board and the House Committee on Natural Resources, which is in charge of Puerto Rico affairs, including PROMESA. The board limited its response to a “yes,” while a committee aide who asked to not be named, also affirmed that the entity established by Congress is independent from the federal government.

“We are not there. We can’t tell the [board’s] director what to do. We can send them letters, but that doesn’t mean they have to fall one way or the other,” the committee aide told the CPI. He added that the board can receive requests for information from Congress and communicate with staffers, but the entity is not required to respond.

“Obviously, it’s in good nature they do [respond] to avoid embarrassing Congressional hearings and what not,” he further noted.

Two experts in constitutional law argued that the different congressional bodies have carte blanche to control the Fiscal Board’s daily operations, nor require specific actions other than through the legislative process.

After reviewing some emails where congressional offices interact with members and officers of the Board, attorney Efrén Rivera Ramos warned that so-called “plenary powers” belong to Congress and not U.S. lawmakers in their individual capacity. “Plenary is not absolute,” said the former dean and professor at the University of Puerto Rico Law School.

“A senator or representative can’t give orders. It’s Congress, which acts as a body,” Rivera said. He noted that the Fiscal Board is subject to “an informal pressure from certain people with certain interests… There are many interests that are trying to prevail.”

According to Carlos Ramos González, a lawyer and professor at the Puerto Rico Interamerican University Law School, Congress created the Board and gave it “independence” by not officially placing it under any “power to which [the Board] has to report, except for those reports that they have to deliver annually [to Congress]. That is to say, they created it and made it free, yet always with an eye on it, because ultimately ‘you are mine.’”

The Board projects itself publicly as a “depoliticized” entity. Its chairman, José Carrión, has repeatedly criticized the politicization of PREPA and the “career politicians” in government who seek to “win political sympathies.” However, the documents obtained by the CPI show that members of the Board respond directly to the Republican or Democratic parties, and the congressional offices that paved the way for their appointments.

As provided by PROMESA, the majority and minority delegations in Congress recommended to President Obama six of the seven members that comprise the Fiscal Board: four by Republicans (insurance broker Carrión, banker García and professors Biggs and Skeel) and two by Democrats (budget guru Matosantos and former bankruptcy judge Arthur González). The White House directly appointed the seventh member (banker José Ramón González). That leaves the count 4-3 in favor of the GOP and would remain that way despite the recent midterm elections, provided President Donald Trump and the new Democratic House majority appoint one of their own in August 2019.

The emails “are shocking because when we think or read something about the Board, we think that Congress wanted to create something independent. But the term ‘independent,’ in my interpretation, only referred to the political class of Puerto Rico. [The Board] was never intended to be independent of Congress,” Ramos González said.

For Rivera Ramos, PROMESA has “rearticulated” Puerto Rico politics, taking away policy decisions from the leading political parties on the island, and putting them into the hands of the Republican and Democratic parties.

Connections

The documents obtained also show frequent “introductory emails” and coordination of meetings with advisers, federal officials and potential contractors. This happens either directly or indirectly through Board lobbyists, particularly D.C. firm Williams & Jensen.

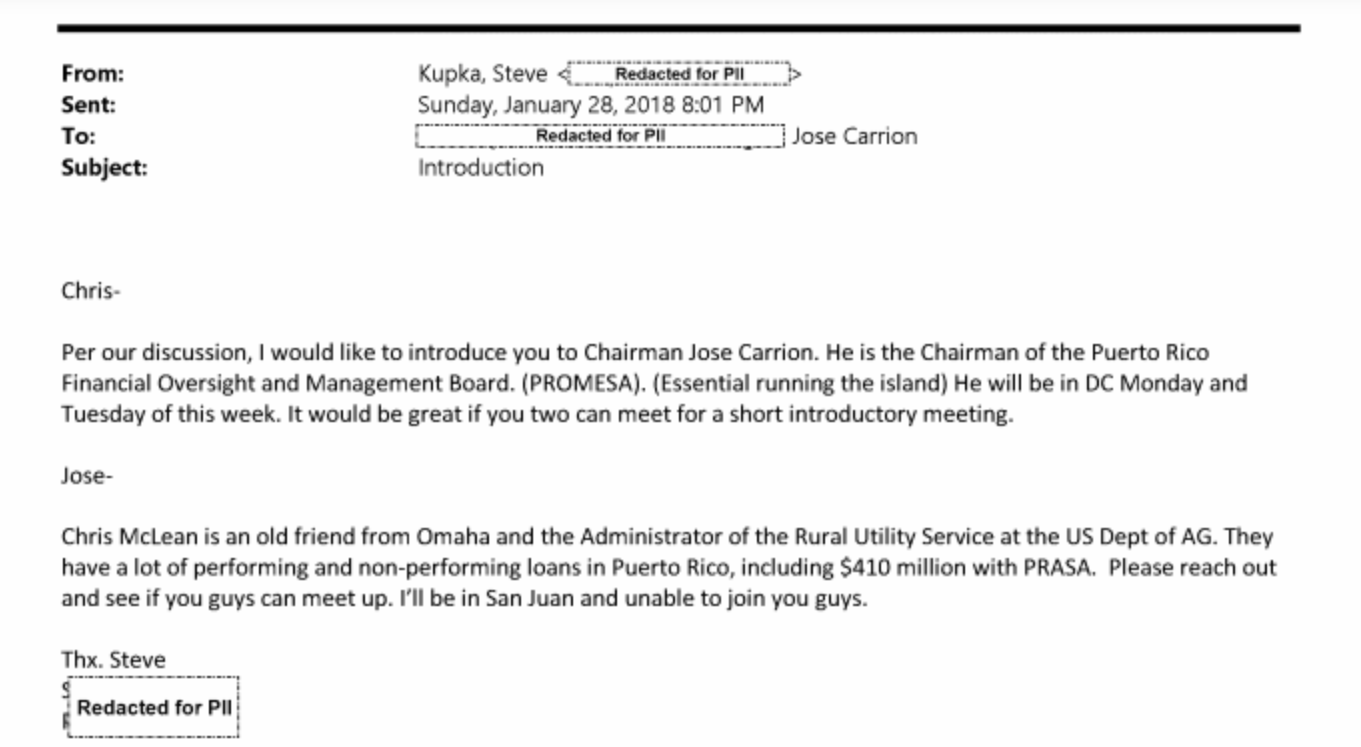

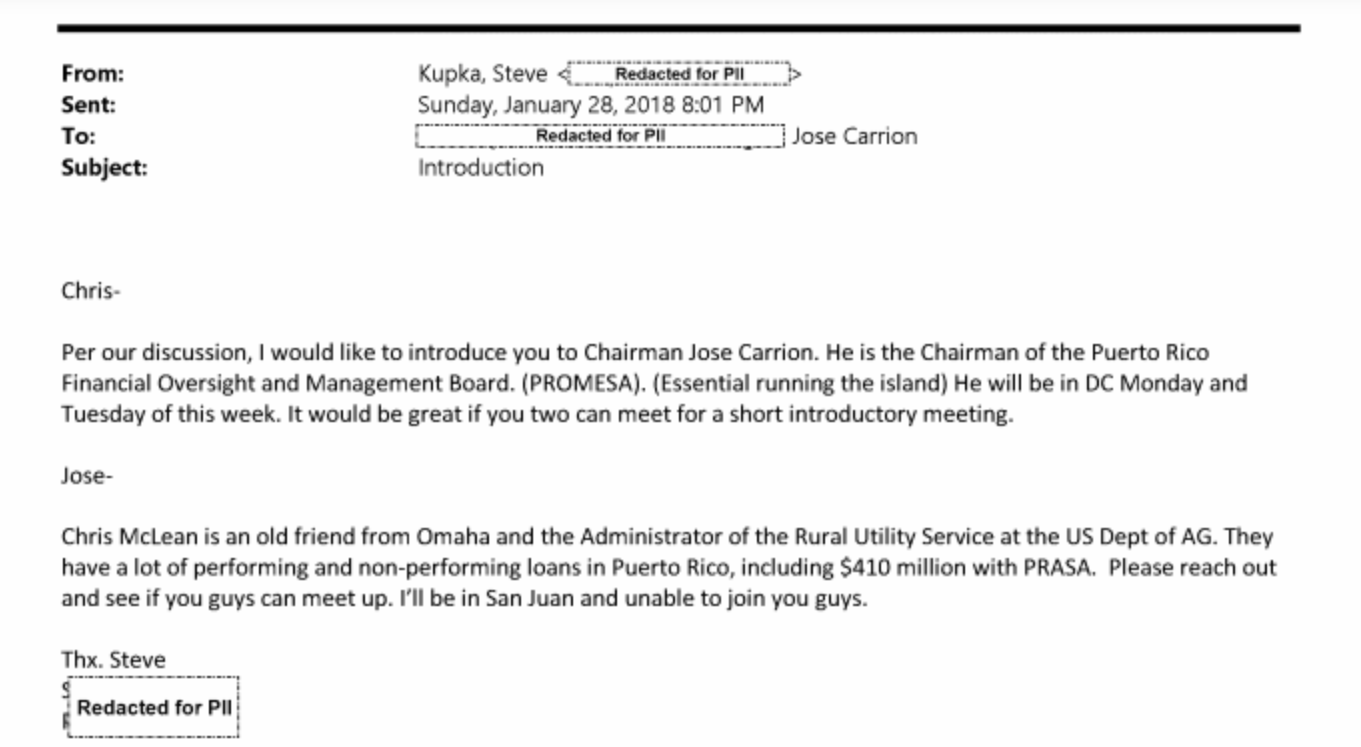

There are other intermediaries such as Steven Kupka, a partner at law firm King & Spalding, who wrote on January 28 to Chris McLean, an officer of the U.S. Department of Agriculture (USDA):

“Chris, per our discussion, I would like to introduce you to Chairman Jose Carrion. He is the Chairman of the Puerto Rico Financial Oversight and Management Board. (PROMESA). (Essential running the island). He will be in D.C. Monday and Tuesday of this week. It would be great if you two can meet for a short introductory meeting. Jose, Chris McLean is an old friend from Omaha and the Administrator of the Rural Utility Service at the [USDA]. They have a lot of performing and non-performing loans in Puerto Rico, including $410 million with [water utility] PRASA. Please reach out and see if you guys can meet up. I’ll be in San Juan and unable to join you guys.”

Kupka does not work for the Fiscal Board, despite his close relationship to Carrión. He is the lead lobbyist of power utility PREPA. His firm, King & Spalding, was also selected by the commonwealth’s Public Private Partnerships Authority as a legal service provider in potential transactions.

Notwithstanding his more than $8 million in contracts with the Rosselló Nevares administration, Kupka —a longtime lobbyist tied to the Republican Party— has coordinated meetings between Carrión and federal officials on more than one occasion. On February 28, Kupka connected the board’s chairman with Drew Maloney, then a legislative affairs adviser in the U.S. Treasury and now chair of the American Investment Council, a group that represents private equity funds.

Kupka also helped to arrange a meeting between Carrión and Andrew Olmem, special assistant to President Trump and the lead person in the White House for everything related to Puerto Rico. Last May the King & Spalding lawyer participated of a dinner held at Carrión’s residence in Dorado, where GOP congressman Bishop was also in attendance.

The CPI asked Kupka if his relationship with Carrión while serving as a lobbyist for PREPA does not represent a conflict of interest, but as of press time, he had not replied.

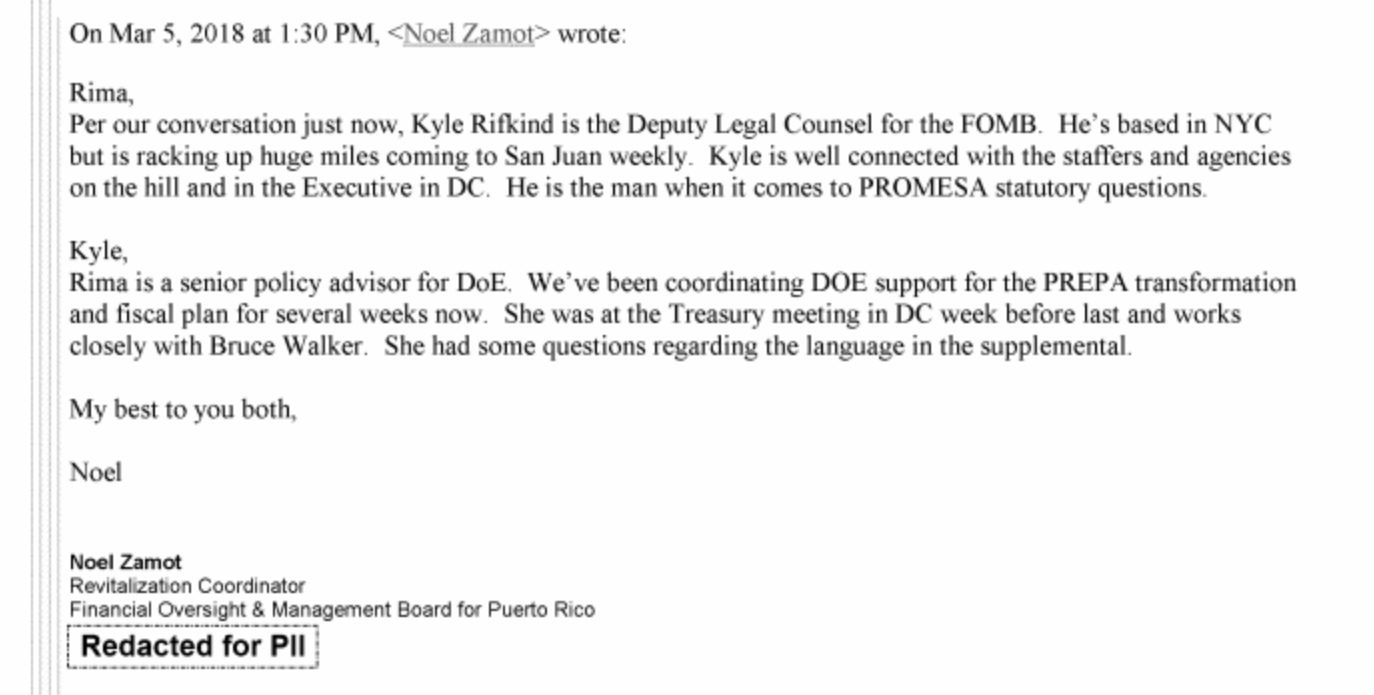

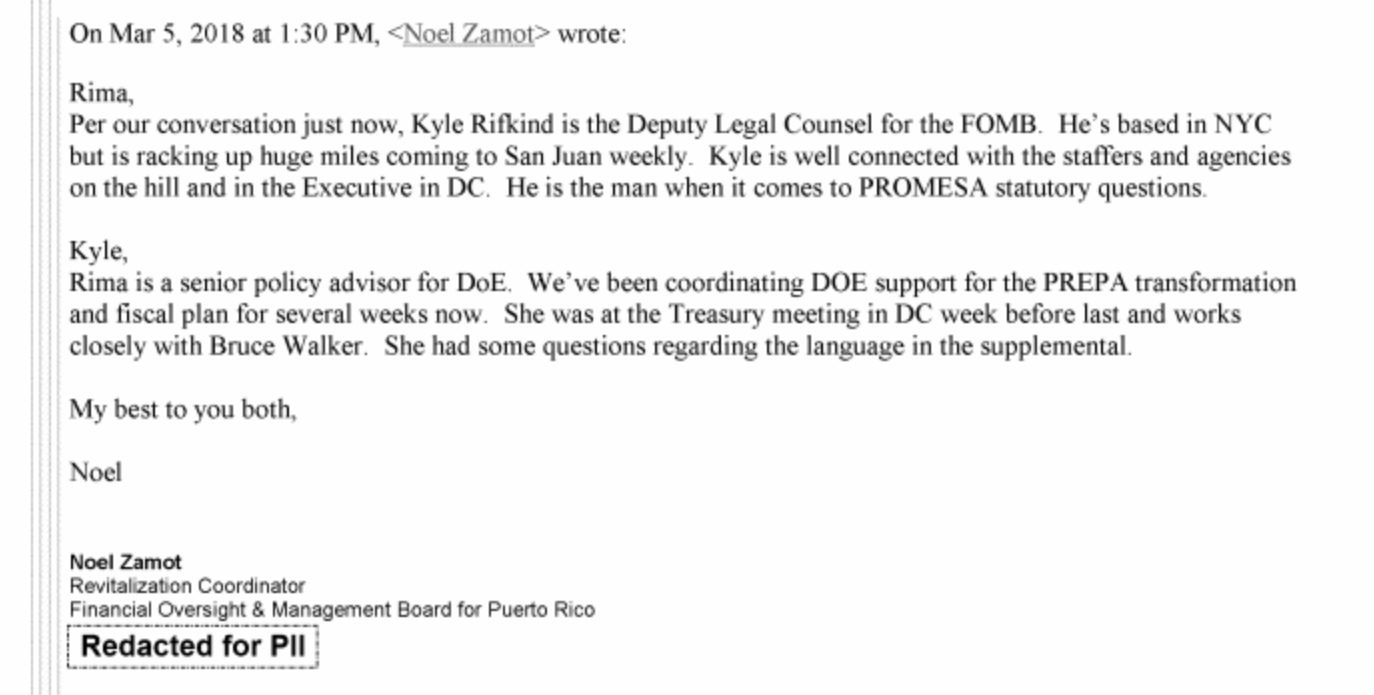

Another key figure that stands out in the emails is that of Kyle Rifkind, deputy in-house counsel of the Fiscal Board and one of the people who constantly shares information between the entity established by PROMESA and officials of Congress, Treasury and other federal agencies.

“Kyle is well connected with the staffers and agencies on the Hill and in the executive in D.C. He is the man when it comes to PROMESA statutory questions,” said in a March 5 email Noel Zamot, the board’s revitalization coordinator, when he introduced Rifkind to Rima Oueid, an adviser at the DOE.

Interactions between board members and federal officials occur by phone or in person, formally or casually, such as over a coffee, lunch or dinner, or perhaps “a few drinks,” as suggested last year by Kent Hiteshew, a former Treasury official who worked on PROMESA matters and now advises the board as a private contractor in Ernst & Young.

“Mr. Carrión and Ms. Jaresko could continue on for drinks after your meeting but not dinner as they have another commitment,”Rosemarie Vizcarrondo, the Board’s chief of staff, replied to Hiteshew’s invitation

From Treasury, Hiteshew and Adam Chepenik played key roles in the conception of PROMESA and the board’s operations. Both are now part of the team of consultants at Ernst & Young, which advises the board to the tune of more than $6.3 million invoiced to date.

Treasury

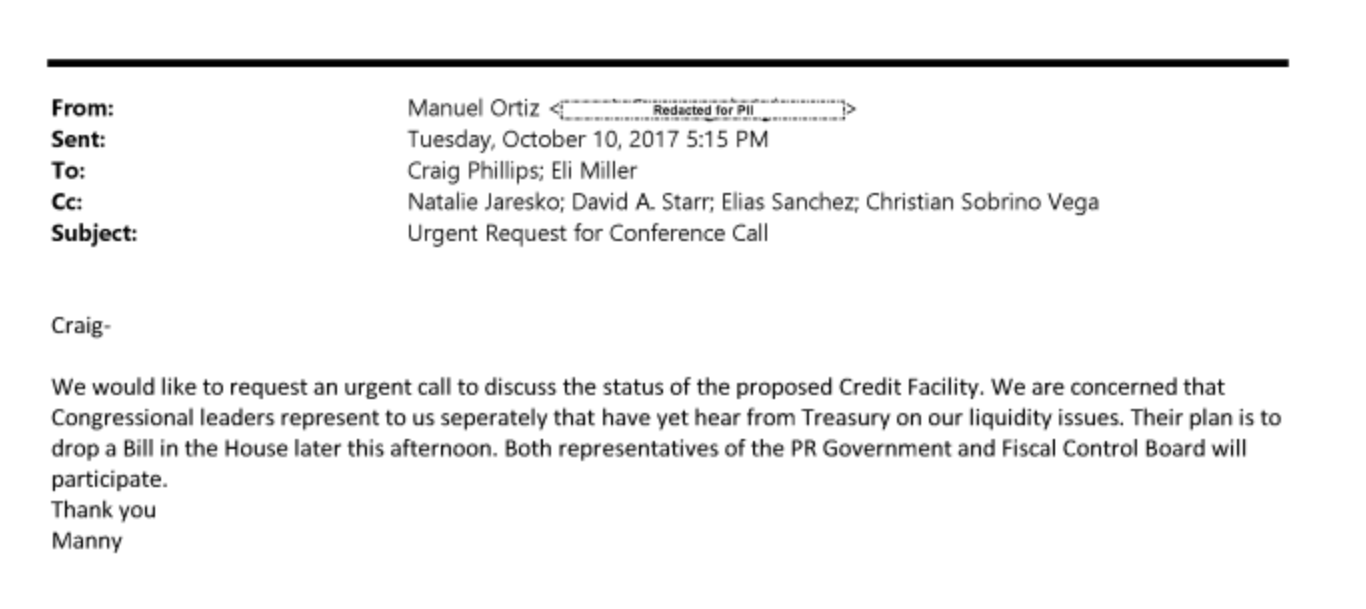

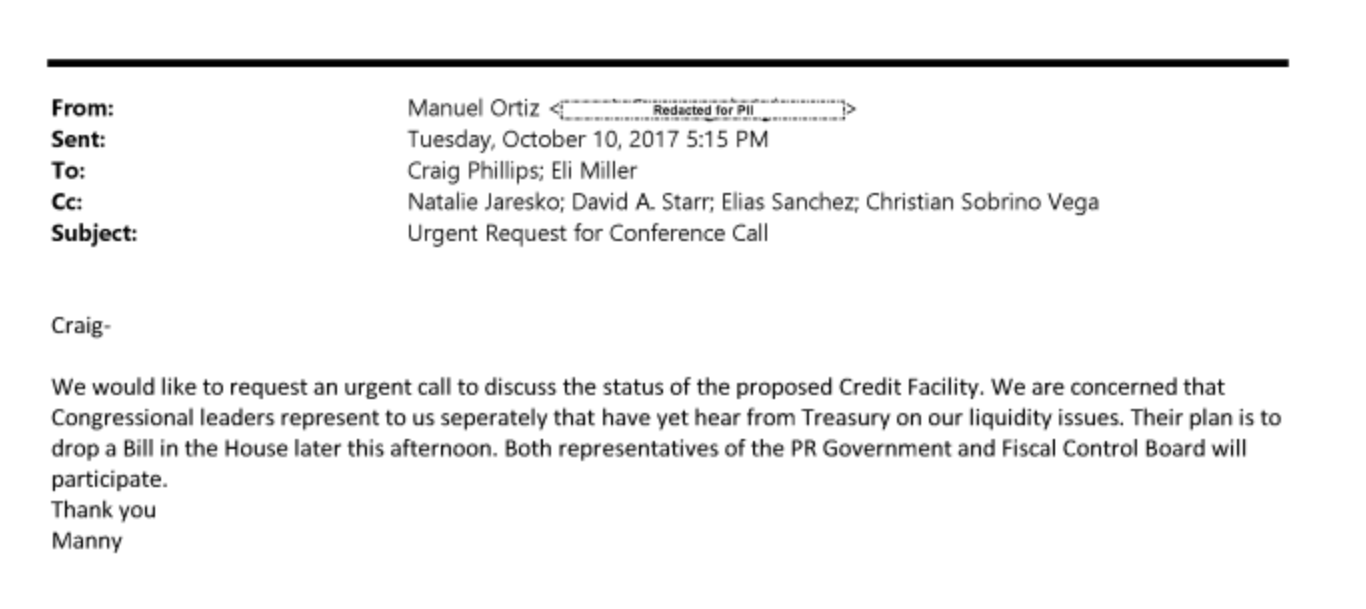

Almost three weeks after Hurricane María, Manuel Ortiz, lead lobbyist for Rosselló Nevares in Washington, wrote to Craig Phillips, a U.S. Treasury official, to request an urgent meeting to discuss the liquidity needs facing the island. Among the people who were copied in Ortiz’s email are Christian Sobrino, the governor’s representative to the board, and his predecessor, Elías Sánchez, who had left the government two months earlier.

Phillips, a senior adviser to Treasury Secretary Steven Mnuchin, replied that they were “working in concert across the [Trump] administration” and requested a meeting with Jaresko to further discuss the matter. He emphasized that “there will be only one voice to the Hill” and that “there is no need for a separate call.”

Two days later, Phillips asked Jaresko if Ortiz worked as a lobbyist for the board. The executive director clarified that Ortiz represents Rosselló Nevares.

“Probably should be made clearer when he write (many) people and copies you,” Phillips countered.

Treasury has been key in the operation of the board since its conception during the Obama administration. Now under the Trump administration, there are new faces at Treasury working on the Puerto Rico case, but the role of the federal agency remains the same. As for Phillips, he is one of the top federal officials who maintains constant communication with the board’s staff, a role similar to that of Kent Hiteshew or Antonio Weiss, a former adviser to the past Treasury secretary, Jacob Lew.

From a 2018 Fiscal Control Board Meeting

Prior to joining Treasury, from 2008 to 2017, Phillips worked for BlackRock, the largest investment firm in the world. In 2014, BlackRock bought $10 million in Puerto Rico junk-grade general obligation bonds. He was a managing director, member of the firm’s Global Operating Committee and global head of the Financial Markets Advisory Group at BlackRock Solutions. The investment firm also has significant stakes in companies with presence in Puerto Rico such as Santander, General Electric, Walmart and CoreCivic, a U.S.-based prison company that currently awaits for the Fiscal Board’s approval of a $25 million, five-year contract with the commonwealth’s Corrections & Rehabilitation Department.

Similar to Congress, the range of issues handled by Treasury go from how much cash the Puerto Rico government has and the establishment of the board’s operations, to the Community Disaster Loans following Hurricanes Irma and María and the approval process of the commonwealth’s fiscal plans. Another issue closely followed by the federal agency is the privatization of power utility PREPA. Earlier in the year, Phillips reacted to Rosselló Nevares’ announcement of plans to privatize the public corporation by saying that “this communication pattern is not tolerable” and that “there was no mention of doing this imminently.” On another occasion, Phillips sought to coordinate a dinner with board members and suggested the possibility of having Sobrino, the governor’s representative, attend the event.

“I understand the value of having Christian present, but that then limits the Board to a narrower discussion of PREPA only,” Jaresko said. “I am fine if you do not think it is the right format for Christian to attend,” Phillips replied.

Another email thread shows Phillips asking Jaresko for an “update on timing” and a meeting about the announcement made by the Fiscal Board in December of 2017 on the more than $6 billion that the government had in other bank accounts outside its main Treasury Single Account (TSA). “The publication was announced before the open of markets today,” Jaresko replied.

Other Treasury officials who regularly hold discussions with the Fiscal Board are Gary Grippo, deputy assistant secretary for public finance, and Amyn Moolji, a senior public policy adviser at Treasury’s Office of Capital Markets. Moolji worked as a director at Taconic Capital Advisors, a hedge fund that bought $15 million in Puerto Rico GO bonds in 2014 and is currently a member of the COFINA Senior Bondholders’ Coalition, owning roughly $390 million in sales tax-backed Cofina bonds. For his part, Grippo has been working in Treasury for the past seven years.

Requests for comment sent to Treasury and Ryan’s office over the role they have played with Puerto Rico’s fiscal board were not responded at press time.

The emails were delivered to the CPI by the Fiscal Board’s lawyers, Proskauer Rose, and are only part of the communications requested. As of press time, the board had not disclosed how many messages it excluded from the delivery. The entity refused the delivery of countless communications, claiming that they are confidential documents and their disclosure would affect Puerto Rico’s economy, capital markets and the board’s ability to exercise its powers. In addition, the entity expects to make a second delivery in January, this time featuring communications between the Fiscal Board and the Puerto Rico government.

This is the first story of the series Puerto Rico Fiscal Board’s Emails.

[…] with local and federal government entities included in the series “Los emails de la Junta” (“The Board’s Emails”). Some revelations were even mentioned by Puerto Rican U.S. Supreme Court Justice Sonia […]